What is FinTech?

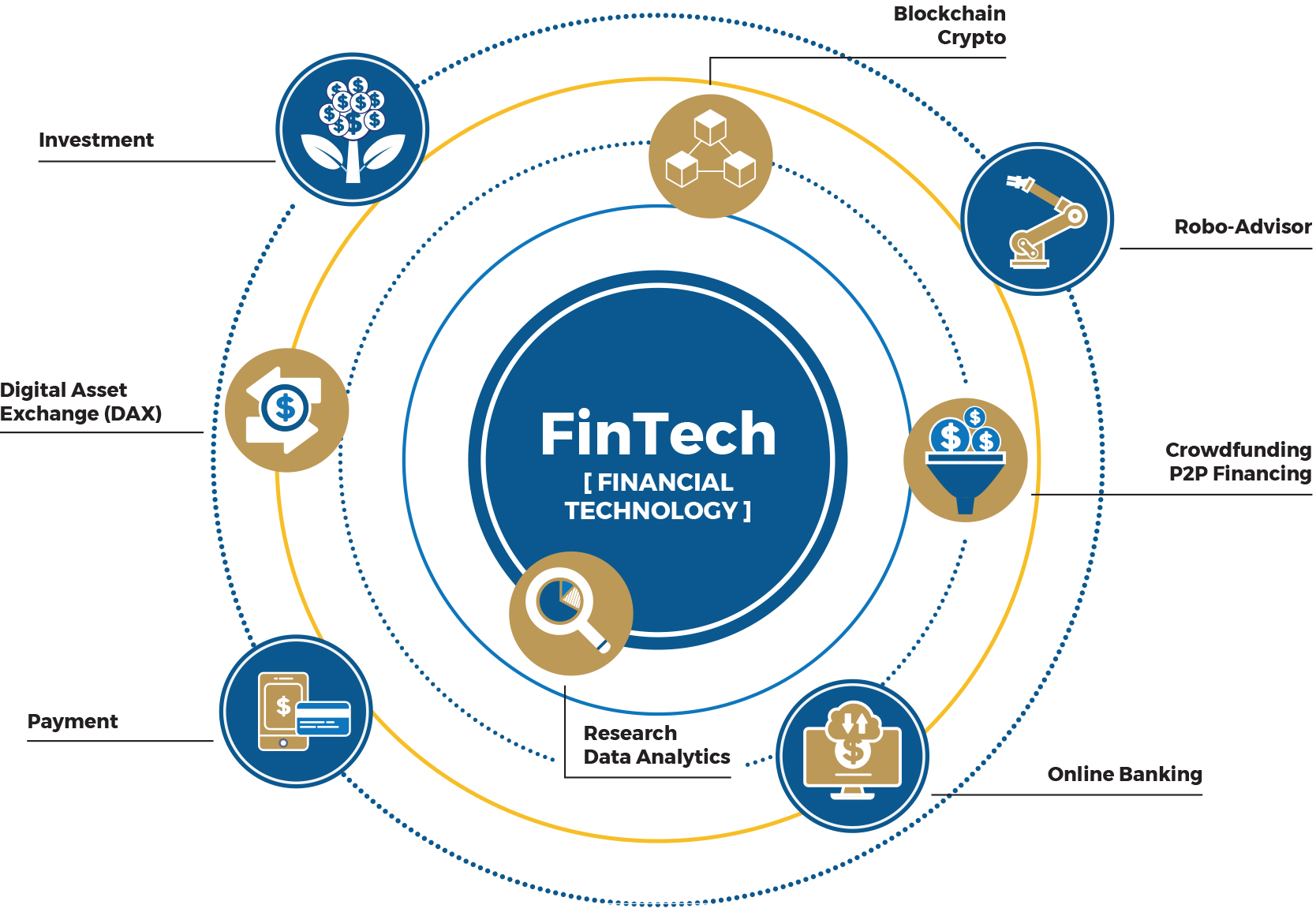

Financial technology is the technology and innovation that aims to compete with traditional financial methods in the delivery of financial services. It is an emerging industry that uses technology to improve activities in finance.

FinTech For The Future

Financial Technology (FinTech) is gaining momentum year-on-year and creating a huge demand for professionals with specific FinTech skills. Traditional accounting and finance industry is getting digitally transformed. To cater to the skill gap in the Financial Services the technology application has become an essential part of the graduate skill.

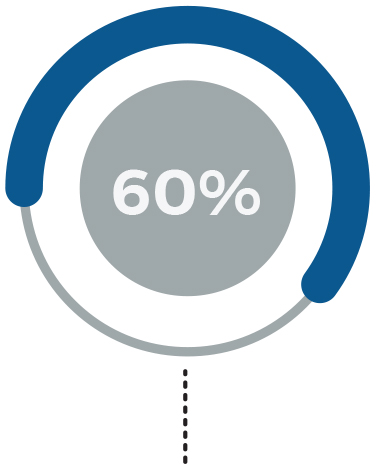

Traditional financial institutions and FinTech start-ups alike are looking for more candidates who specialise in artificial intelligence, machine learning and data science. According to reporting by Bloomberg reporting and data from LinkedIn[1], job listings requiring these skills in the financial industry increased nearly 60% in the past year.

|

APU's FinTech degrees at undergraudate and postgraduate levels are designed to provide you with an edge with the latest technologies that are in line with the Industrial Revolution 4.0. Being the first university to offer undergraduate programmes related to FinTech in 2018, APU is the pioneered FinTech educator at both Undergraduate and Postgraduate levels in Malaysia.

To cater to the increased demand for graduates with FinTech skills, APU’s FinTech programmes are designed to prepare our graduates with the necessary knowledge to be highly employable upon graduation. The programmes with FinTech specialism are listed as below:

- Bachelor of Science (Honours) in Information Technology with a specialism in Financial Technology (FinTech)

- Bachelor in Banking and Finance (Hons) with a specialism in Financial Technology

- Bachelor of Science (Honours) in Actuarial Studies with a specialism in Financial Technology

- Bachelor of Financial Technology (Honours)

- Master of Finance with a specialism in FinTech

Source: [1] https://www.bloomberg.com/news/articles/2019-08-20/finance-needs-people-who-work-well-with-robots

"FinTech is massively popular. 96% of global consumers are aware of FinTech-driven money transfer and payment services. 3 out of 4 consumers have used an alternative money transfer and payment service." - EY Global FinTech Adoption Index |

60% of consumers want to transact business with financial institutions with a single platform, such as social media or mobile banking apps.

(Ernst & Young)

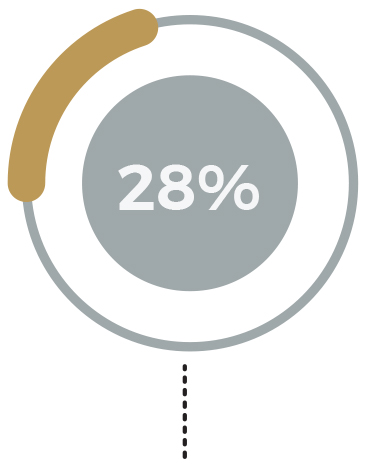

"Global FinTech market investments have seen a 28% year-on-year rise from 2018 to 2019."

Tranglo

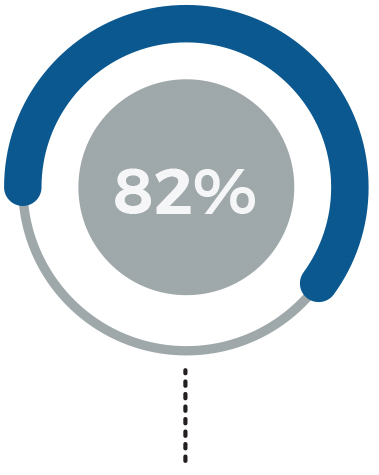

In 2017, 88% of incumbent financial institutions feared that they would lose money to the disruptive innovation of FinTech companies, but 82% plan to partner with FinTech startups in the next 3–5 years.

(PwC)

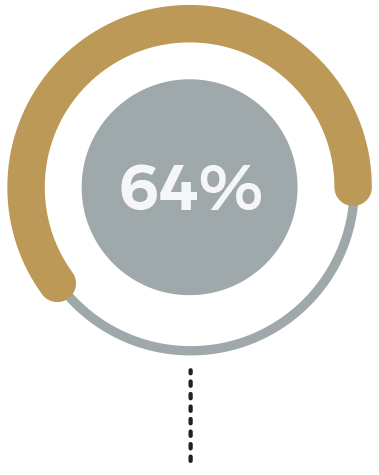

In 2019, 64% of consumers worldwide have used one or more FinTech platforms, up from 33% in 2017.

(Ernst & Young)

"Financial institutions are becoming more technology focused. We see it as the evolving intersection of financial services and technology. Looking forward, we expect FinTech disruptors to continue to expand into other areas within financial services." - Pricewaterhouse Coopers (PwC) |

"FinTech is changing businesses and customers rapidly. Those that embrace FinTech will stay at the forefront of their markets; those that don't will lose out on opportunities, customers, and market share." - Bernard Marr, Forbes |

Shaping FinTech Ecosystem in Malaysia

-

Bachelor in Banking and Finance (Hons) with a specialism in Financial Technology

Self-Check Questions

- Are you considering a career in the banking and finance sector?

- Are you ready to enhance your skills as a banker in today’s digital age?

- Are you interested in integrating banking expertise with technological innovation?

FinTech Ecosystem

FinTech Operation Support and Marketing

FinTech modules

- Financial Technology

- Python for Financial Applilcations

- Digital Currencies and Blockchain Technologies

- Crowdfunding and Alternative Lending

- Applications of AI in Finance

- Enterpreneurial Finance

- Robo Advisor

- Fintech Risk management and Regulations

Main Career Pathways

- FinTech Marketing Consultant

- FinTech Product Manager

- FinTech Compliance officer

- Customer Service FinTech

Click HERE for more details about the Bachelor in Banking and Finance (Hons) with a specialism in Financial Technology programme. -

Bachelor in Financial Technology (Honours)

Self-Check Questions

- Are you seeking to build a career in the rapidly evolving FinTech industry?

- Do you aspire to unleash your creativity in addressing financial issues in rapidly digitalized financial markets?

- Are you passionate about transforming ideas into innovative financial products or solutions?

- Are you driven to innovate within the financial sector and grow your entrepreneurial ability?

FinTech Ecosystem

FinTech Product and Strategies FinTech Visionary leader

FinTech modules

- Intro of Artificial Intelligence

- Financial Technology

- Python for Financial Applilcations

- Digital Currencies and Blockchain Technologies

- Applications of AI in Finance

- Human Computer Interaction

- Cloud Infrastructure and Services

- Big Data and Visual Analytical in Accounting & Finance

- Cybersecurity

- Fintech Risk Management and Regulations

Main Career Pathways

- FinTech Specialist

- FinTech Product Developer

- FinTech Entrepreneur

- FinTech Product Analyst

- FinTech Consultants

-

Bachelor of Science (Honours) in Information Technology with a specialism in Financial Technology (FinTech)

Self-Check Questions

- Are you interested in pursuing a career in a bank's IT/CISO department?

- Do you have a passion for financial innovation and a desire to develop fintech applications?

- Do you envision yourself creating innovative financial software solutions and building the IT infrastructure?

FinTech Ecosystem

FinTech Solutions and Infrastructure

FinTech modules

- Network Security

- Financial Technology

- Financial Management

- Distributed Computer Systems

- Blockchain Development

- Emergent Technology

- Fintech Risk Management and Regulations

Main Career Pathways

- FinTech Systems Analyst

- IT and FinTech Consultant

- FinTech Infrastructure Administrator

- FinTech System Developer

- FinTech Project Manager

Click HERE for more details about the Bachelor of Science (Honours) in Information Technology with a specialism in Financial Technology (FinTech) programme. -

Bachelor of Science (Honours) in Actuarial Studies with a specialism in Financial Technology

Self-Check Questions

- Do you aspire to stay ahead in the actuarial field by mastering the intersection of FinTech and data science?

- Are you looking to expand your data analytics skills to incorporate the latest FinTech advancements?

- Are you eager to apply your actuarial expertise to develop cutting-edge financial models for the FinTech sector?

FinTech Ecosystem

FinTech Modelling and Analytics

FinTech modules

- Financial Technology

- Python for Financial Applilcations

- Applications of AI in Finance

- Fintech Risk management and Regulations

Main Career Pathways

- FinTech Analyst

- Data Analyst

- FinTech Risk Manager

Click HERE for more details about the Bachelor of Science (Honours) in Actuarial Studies with a specialism in Financial Technology programme.

Computing & Technology

Language Programmes

Pathways @ APU

Want to know more ?

Let’s Connect