Part-Time Module Schedule

Requirements

Entry Requirements

- Bachelor’s degree in Actuarial, Mathematics, Statistics or Computing with a minimum CGPA of 2.75, or its equivalent qualification as accepted by the Senate.

- Bachelor’s degree in Actuarial, Mathematics, Statistics or Computing with a minimum CGPA of 2.50 and not meeting a CGPA of 2.75 can be accepted, subject to a rigorous internal assessment.

- Bachelor’s degree in Actuarial, Mathematics, Statistics or Computing with CGPA less than 2.50 as accepted by the Senate and a minimum of 5 years of working experience in a relevant field may be accepted.

- Bachelor’s degree in Finance or Economics with a minimum CGPA of 2.75 as accepted by the Senate, subject to passing pre-requisite courses.

- Bachelor’s degree in Finance or Economics with a minimum CGPA of 2.50 as accepted by the Senate and a minimum of 5 years of working experience in a relevant field may be accepted, subject to passing pre-requisite courses.

- Bachelor’s degree in non-related fields with a minimum CGPA of 2.75 and a minimum of 5 years of working experience in the related fields as accepted by the Senate, subject to passing the pre-requisite courses, professional courses, or accredited micro-credentials program.

Note: The above entry requirements may differ for specific programmes based on the latest programme standards published by Malaysian Qualifications Agency (MQA).

- IELTS : 5.0

What We Teach

This programme is specifically designed to provide:

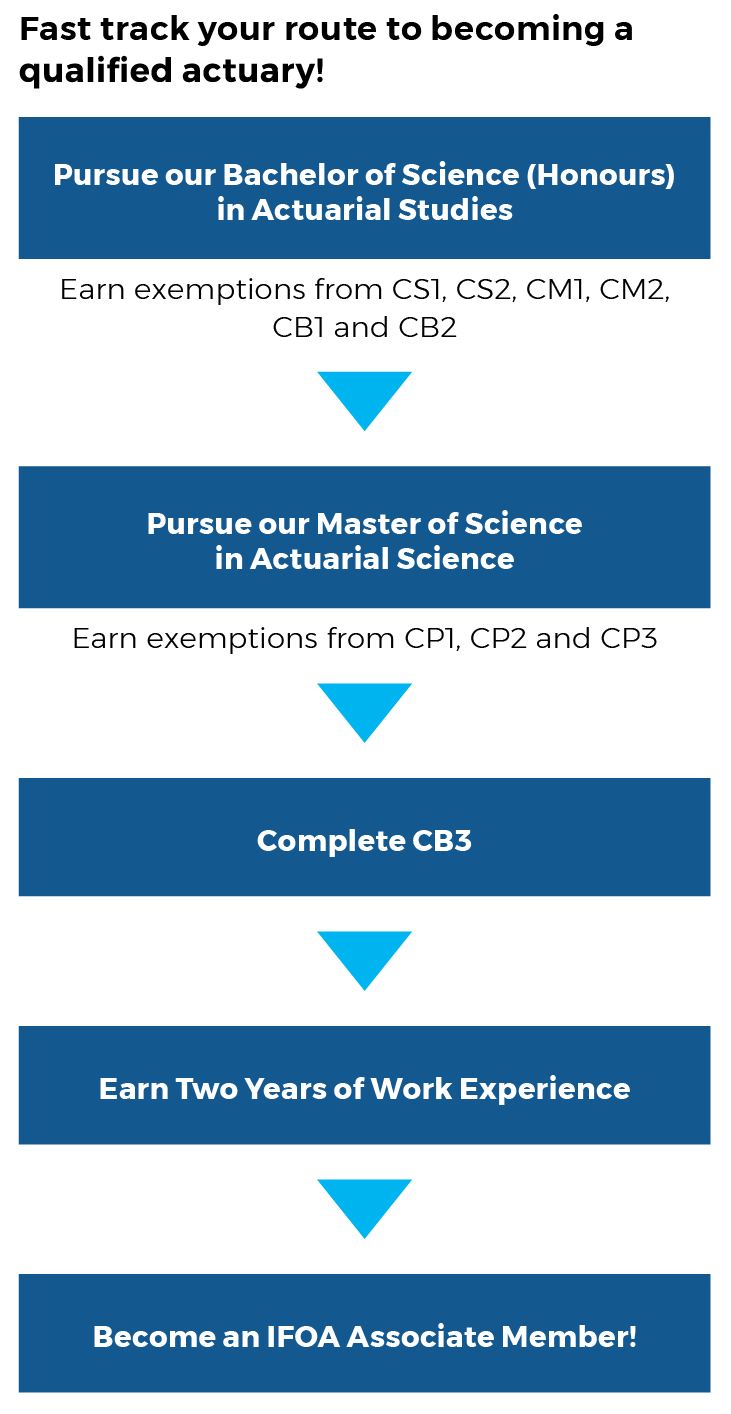

- Coverage of the IFoA curriculum and exemptions from 7 professional exams (CS1, CS2, CM1, CM2, CP1, CP2 & CP3) offered by the IFoA.

- Course syllabus which covers not only traditional actuarial practice but also advanced data analytics.

- Competent teaching staff with professional or specialised academic qualification, possessing work experience from actuarial industries / academia.

- Comprehensive guidance to mould graduates to be industry-ready.

-

The Benefits of the Programme

- APU is the first and the only university in Asia to provide exemptions from CP1, CP2 and CP3 through the Master of Science in Actuarial Science programme.

- Our MSc programme covers not only traditional actuarial practice but also advanced data analytics, an emerging career option for actuaries

- Our MSc graduates who achieve the required standard can be eligible for exemptions from CS1, CS2, CM1, CM2, CP1, CP2 and CP3.

- Our MSc programme is ideal for individuals who:

- Want to enhance their knowledge and skills in actuarial practice and data analytics.

- Work as actuaries or data scientists.

- Are pursuing the IFoA/ SOA/ CAS credentials.

- Want to become university lecturers and/or professors.

-

Modules & Project

This programme comprises 14 coursework modules and a Project. There are 12 compulsory Core Modules, 1 Project and you will choose 2 elective modules from those listed.

Pre-requisite Modules (for non-actuarial students)

Duration: 1 month (Full-time) / 2 months (Part-time)- Introduction to Actuarial Mathematics

- Statistics

Core Modules

- Professional Communication

- Actuarial Practice I

- Risk Modelling and Survival Analysis I

- Actuarial Statistics I

- Actuarial Mathematics I

- Modelling in Actuarial and Analytics

- Actuarial Practice II

- Financial Engineering and Loss Reserving I

- Actuarial Statistics II

- Actuarial Mathematics II

- Application in Industry Practices

- Data Analytics Programming

- Industry-based Project

Elective Modules (Choose 2)*

- Risk Modelling and Survival Analysis II

- Financial Engineering and Loss Reserving II

- Big Data Analytics and Technologies

- Advanced Business Analytics and Visualization

* Elective modules may be pre-selected for students at the beginning of the semester. If students wish to change these pre-selected elective modules, they can choose from the available modules offered in the semester OR among the intensive delivery modules - however such changes may prolong the study duration. -

Project

You will be expected to demonstrate an ability to plan and undertake a research programme, to undertake a thorough investigation of their chosen area of study, to extend knowledge in relation to their chosen area of study and to defend their work to academic peers. The project report should demonstrate deep understanding of the theories and concepts, and the application of theoretical knowledge to a real world problem for business and industry.

Professional Recognitions

Institute and Faculty of Actuaries (IFoA) UK

Facilities at APU

The APU Centre Point & Atrium serves as a melting pot of cultures from all over the world. Here, cultural activities are organised regularly at the campus, fostering long-lasting intercultural relationships among APU students, who come from over 130 countries.

Ready, Set, Go.

Whether you are locals or traveling here, we have the options for you to pursue your dreams.

RM38,800

Total for Malaysian

RM42,000

(USD11,050)

Total for International

Programme code : (N/0542/7/0002)(07/29)(MQA/PA17434)

All information is correct at the time of publication, but is subject to change in the interest of continuing improvement.

Note : All fees are payable in Ringgit Malaysia (RM). Any USD amounts indicated by APU are for reference only and are non-binding. The final amount payable is the RM amount stated in the official invoice, and the University will not entertain any claims arising from foreign exchange fluctuations.

Postgraduate Studies

Learn More

Awards & Recognitions

Learn MoreAPEL.C

Online Learning

Facilities

Want to know more ?

Let’s Connect