APU Students Win National Actuarial Competition with Innovation and Heart

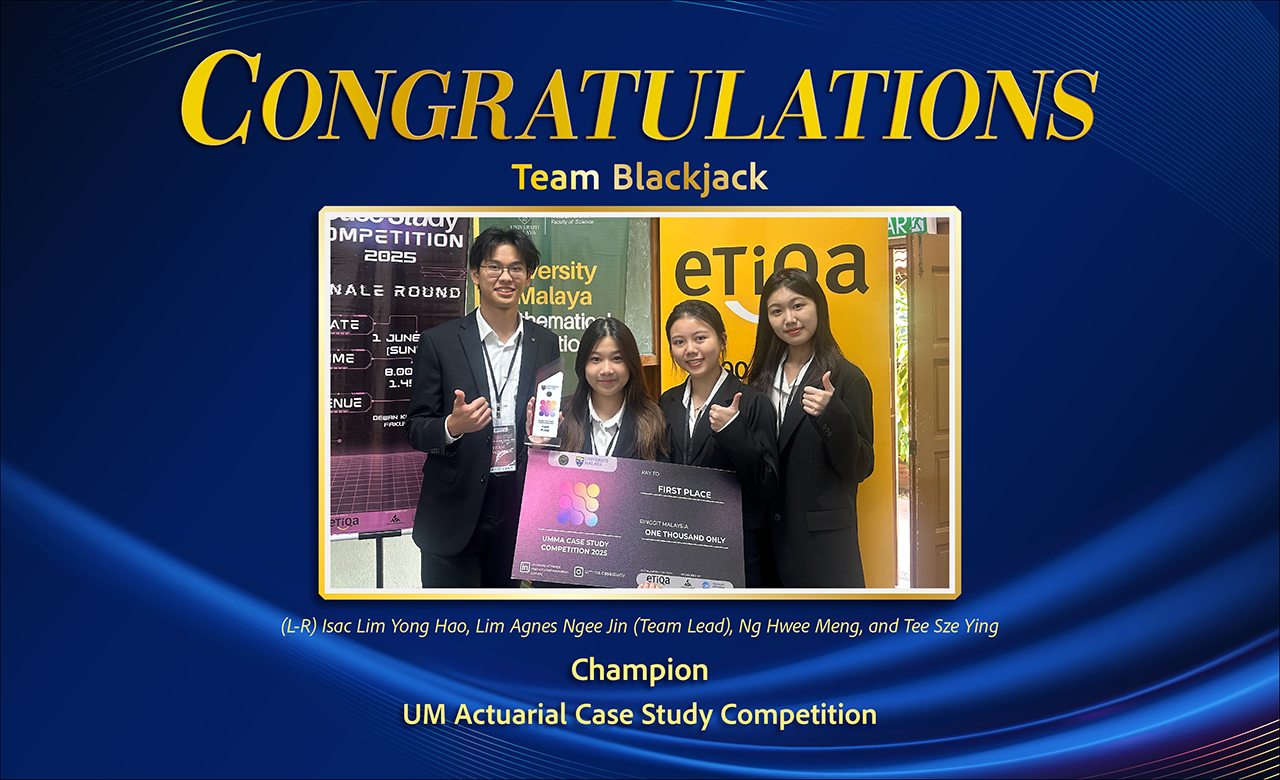

On 2 June 2025, a self-initiated student team from the Asia Pacific University of Technology & Innovation (APU) made history by clinching the Champion title at the UM Actuarial Case Study Competition—a national-level challenge organised by the University of Malaya Mathematical Association (UMMA).

What made their victory all the more inspiring was that they relied solely on their friendship, cross-disciplinary strengths, and shared determination.

The idea came from Lim Agnes Ngee Jin, a BSc (Hons) in Actuarial Studies with a specialism in Data Analytics student. Driven by a passion to challenge herself and her peers, Agnes reached out to her close friends from foundation year: Tee Sze Ying, also from the actuarial programme; Ng Hwee Meng, a Computer Science student specialising in Data Analytics; and Isac Lim Yong Hao, a Diploma student in Information and Communications Technology. Together, they formed an unlikely but powerful quartet – Team Blackjack.

A Self-Initiated Dream that Took Flight

Held on campus at the University of Malaya, the competition brought together top actuarial minds from universities nationwide. While the challenge primarily focused on actuarial solutions, the organisers welcomed students from any discipline, provided each team included at least two actuarial science students. This inclusivity set the stage for multidisciplinary collaboration.

Lim Agnes Ngee Jin explained her rationale:

“I believed our combined backgrounds would create a well-rounded team. I took on the role of team leader and guided the coordination of our project, timelines, and responsibilities.”

With her leadership, the team combined analytical rigour with creative tech-based solutions. Actuarial students took charge of risk quantification and pricing models, while their tech-savvy peers handled data visualisation, prototype development, and programming. The group’s shared proficiency in R became the common ground on which they built their entire solution.

A Real-World Challenge, A Real Impact Solution

Participants had just over two weeks, from 3 to 18 May, to analyse three years of catastrophe-related insurance claims data and build a solution. Finalists were announced on 25 May, and the Grand Finale took place on 2 June, where teams presented their findings to a panel of industry and academic judges, most notably, the CEO and representatives from ETIQA Insurance and Takaful, who co-hosted the competition.

The team’s project went far beyond basic modelling.

“We applied advanced techniques like GLM and XGBoost to uncover hidden patterns in claims data. We also developed a flood risk scoring system based on elevation, water proximity, and infrastructure quality,” said Tee Sze Ying, also an actuarial student.

Their final product was a comprehensive, refined insurance model that introduced risk-based pricing, catastrophe loadings, tiered deductibles, and parametric limits. Most impressively, they designed an ESG-aligned subsidy system to support vulnerable communities, including a community pooling model targeting Malaysia’s B40 population.

Empowered by Challenge, United by Trust

As a self-initiated team, the challenges they faced were undeniably daunting.

“It was stressful but empowering. We had to triple-check our models, coach each other in presentation delivery, and fine-tune every detail as a team. We learned to trust ourselves—and each other—entirely,” Ng Hwee Meng reflected.

Their triumph was a surprise to many, including themselves. But their victory was not just about beating the odds; it was a testament to the power of student initiative, teamwork, and purpose-driven innovation.

What Set Them Apart

Several key strengths contributed to their standout performance:

- Initiative: Although prototypes weren’t required, the team created two fully functional simulations in R—one for premium modelling and another for visualising risk scores.

- Creativity: Their community pooling model addressed affordability for flood protection among lower-income groups through a sustainable, self-subsidising structure.

- Social Impact: By aligning their work with Environmental, Social, and Governance (ESG) principles, their project balanced technical excellence with real-world compassion.

- Engaging Storytelling: Instead of relying solely on numbers, the team connected their models to real-life implications, making their solutions both technically sound and emotionally resonant.

More Than a Trophy

For this exceptional team, winning wasn’t just a title—it was proof that when friendship, foresight, and fearlessness come together, the results can be truly extraordinary.

“This experience was more than a competition. It was a milestone,” Agnes, the team lead, shared proudly. “I am beyond proud to have achieved it with my team, representing APU.”

Their story stands as an inspiration not only to fellow students of actuarial science, data analytics, and ICT but also to anyone who dares to lead, innovate, and rise together.

In addition to taking home the champion title and an RM1,000 cash prize, Team Blackjack also secured a prestigious internship opportunity at Etiqa, further validating the real-world relevance of their solution.

The first runner-up position was claimed by Team Z2 & L2 from the University of Malaya, while Team Nubiks from Sunway University emerged as the second runner-up, rounding off a highly competitive and memorable event.

News & Happening

Download e-Brochures

Intake Calendar

Want to know more ?

Let’s Connect