Asia Pacific University of Technology & Innovation (APU) offers Malaysia’s first Master of Science in Actuarial Science covering all the three core practice curriculum ― CP1, CP2, and CP3 ― the higher level professional exams offered by the Institute and Faculty of Actuaries (IFoA).

KUALA LUMPUR, 28 August 2024 — Asia Pacific University of Technology & Innovation (APU) again takes the lead in advanced education with its ‘Master of Science in Actuarial Science’, establishing new standards for the industry.

As Malaysia’s Premier Digital Tech University and the first in the country to receive accreditation from the UK Quality Assurance Agency for Higher Education (QAA), along with a QS 5-Stars Plus rating, APU is earning worldwide recognition for its high standards and innovative approach.

This distinction is further demonstrated by the success of its groundbreaking postgraduate programme, the ‘Master of Science in Actuarial Science’, which has played a pivotal role in enhancing the university’s global reputation.

This advanced programme goes beyond traditional actuarial practice, incorporating advanced data analytics to accelerate the path to becoming a ‘Professional Actuary and Associate Actuary’.

The curriculum covers a series of professional exams offered by the Institute and Faculty of Actuaries (IFoA), the core principal CS1, CS2, CM1 and CM2 as well as the higher level core practice CP1, CP2 and CP3.

APU’s Head of the School of Mathematics, Actuarial and Quantitative Studies (SoMAQS), Assoc Prof Dr Rajasegeran Ramasamy highlights that the Master’s programme consists of 14 comprehensive coursework modules and a hands-on project.

“These modules are designed to provide solid understanding of actuarial practice and data analytics as well as the knowledge and skills applied primarily in the actuarial works in business and finance industry.

“The project component challenges students to apply their acquired skills to tackle real-world industry-based problems, enhancing their research, analytical, writing, and communication abilities,” he said.

Accredited by the Malaysian Qualifications Agency (MQA) and pending accreditation from the IFoA, this programme offers potential exemptions from seven out of ten IFoA exams (CS1, CS2, CM1, CM2, CP1, CP2, and CP3) upon completion.

It also complements the six IFoA exam exemptions obtained through APU’s Bachelor of Science (Honours) in Actuarial Studies.

For the requirements, applicants should hold a Degree in Actuarial Science or a related field such as Finance, Mathematics, or Statistics.

Graduates can pursue careers as Actuaries in traditional fields such as insurance, pension fields, or consulting firms.

The skills acquired will open pathways to other potential roles, including Data Analyst, Data Scientist, Data Engineer, Risk Analyst, Financial Analyst, Business Analyst, Financial Planning Advisor, and Investment Portfolio Manager in production, healthcare, manufacturing, game development industry, and many more.

With a master’s degree in hand, graduates can also open the door to an exciting academic career, stepping into roles such as a university lecturer or professor.

They will have the opportunity to inspire the next generation of scholars and shape the future of their discipline, whether from the front of a classroom or through groundbreaking research.

APU’s Bachelor of Science (Honours) in Actuarial Studies was recently awarded the prestigious Silver status by the Casualty Actuarial Society (CAS), a well-known institution based in the US, adding to its global recognition with block exemptions offered by the IFoA, UK and recognition by Society of Actuary (SoA), US.

The CAS recognition promotes APU to an elite group of global educational institutions, joining the ranks of just 14 universities worldwide to achieve this prestigious status on the CAS University Recognition List.

The rigorous accreditation and recognition process by the IFoA, SoA and the CAS validates APU’s Actuarial Science programmes’ academic rigour and curriculum relevance, demonstrating the university’s unwavering commitment to excellence in this field.

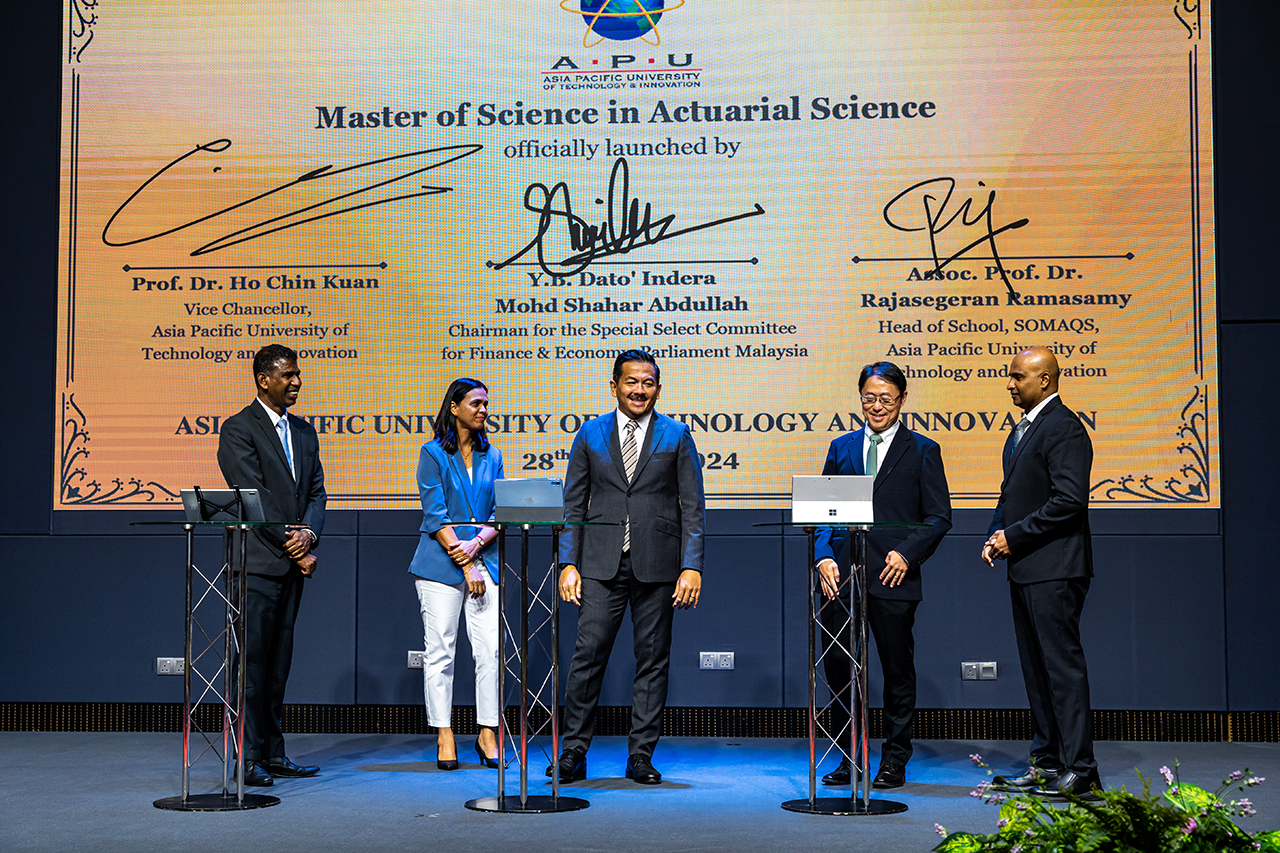

Meantime, the spotlight shone brightly on three distinguished figures: Dato’ Indera Mohd Shahar Abdullah, Chairman of the Special Select Committee for Finance & Economy, Parliament Malaysia; Prof Dr Ho Chin Kuan, Vice Chancellor of APU; and Assoc Prof Dr Rajasegeran.

Together, they marked a historic moment by officially launching the Master of Science in Actuarial Science in conjunction with the Inaugural Malaysia Actuarial Day 2024, highlighted by a signing ceremonial.

Dato’ Indera Mohd Shahar underscores the pivotal role actuaries play in shaping Malaysia’s future and draws attention to the increasing demand for these professionals to address the country’s evolving needs, especially within the insurance sector — a key contributor to Malaysia’s GDP.

According to recent reports from the Actuarial Society of Malaysia (ASM), there are approximately 1,258 registered actuaries actively applying their skills in risk management, financial modelling, and data analytics across various industries.

With Malaysia’s population standing at 34 million, this translates to roughly 0.037 actuaries per 1,000 people — a figure that raises questions about whether it is sufficient to meet the nation’s growing actuarial demands.

“The impact of the insurance industry on our economy is profound,” says Shahar added that, “In 2023, the sector contributed about 1.4% — equivalent to approximately RM25.2 billion —to Malaysia’s GDP (source: Statista 2024).”

He elaborated on the evolving landscape for actuaries, emphasising the challenges and opportunities presented by rapid technological advancements, shifting regulations, and changing consumer preferences.

The digital revolution offers a promising horizon, with digital transaction values in Malaysia approaching RM200 billion in 2024 (Statista Digital Market Insights 2024).

Moreover, in 2023, digital payment methods, including e-money, internet banking, financial process exchange (FPX), and mobile internet saw over 11 billion transactions in total (Bank Negara Malaysia (BNM), 2024).

InsurTech, in particular, highlights the crucial need for actuarial expertise. The global InsurTech market, valued at USD$ 5.45 billion in 2022, is projected to grow at a remarkable compound annual growth rate of 52.7% from 2023 to 2030.

Shahar concluded with optimism, stating, “I am confident that APU will emerge as one of the leading universities in the country, developing competent actuaries to meet the challenges of the digital economy head-on.”

Prof Dr Ho Chin Kuan highlights APU’s distinguished track record in technology-driven education and its commitment to staying ahead of industry trends.

“APU has been at the forefront of actuarial education, integrating emerging technologies into its programmes to meet the ever-evolving demands of the industry,” he said, adding “Our actuarial programmes are globally accredited and prepare graduates for the technological challenges of the industry.”

He further said that one of this year’s achievements was the inaugural Actuarial Day 2024, a groundbreaking event hosted by APU’s School of Mathematics, Actuarial, and Quantitative Studies (SoMAQS) and its co-organiser Universiti Teknologi MARA’s (UiTM) College of Computing, Informatics, and Mathematics (CoCIM).

This landmark event, themed “Actuarial Excellence for a Sustainable Digital Economy”, drew participants from ten top public and private universities, including UiTM, Universiti Sains Islam Malaysia (USIM), Universiti Kebangsaan Malaysia (UKM), Sunway University, Taylor’s University, UCSI University, Heriot-Watt University Malaysia, University of Southampton Malaysia, and University of Malaya (UM).

The event’s prestige was further enhanced by the support of three major professional bodies — the IFoA, CAS, and SoA — who sponsored and contributed to its success.

Adding to the excitement, Actuarial Day 2024 featured a vibrant Career Fair where over 20 leading companies from the actuarial and finance sectors showcased their opportunities.

Leading organisations such as Etika Insurance Takaful, Generali Insurance Malaysia Berhad., and Great Eastern Life Assurance connected with both international and local actuarial students, discussing potential internships and career paths.

This inaugural Actuarial Day was a significant milestone in actuarial education, fostering collaboration, knowledge sharing, and career development within the industry.

News & Happening

Download e-Brochures

Intake Calendar

Want to know more ?

Let’s Connect